East African countries are accelerating the digital transformation of their Value Added Tax (VAT) systems to enhance revenue collection, improve tax compliance, and foster sustainable economic growth.

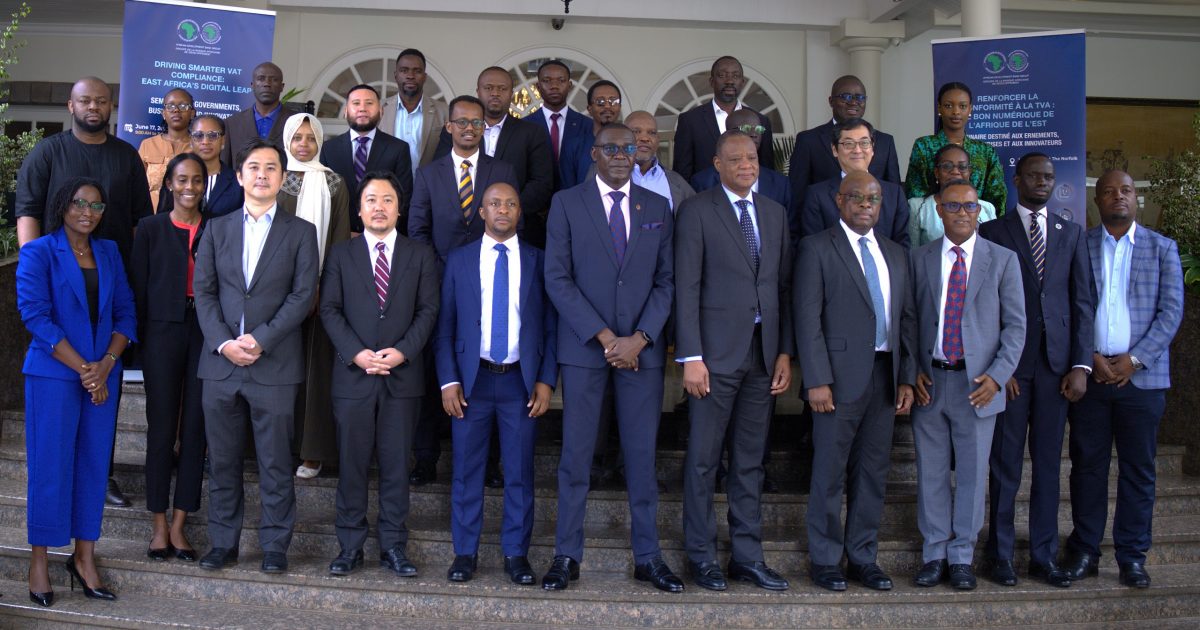

This commitment was reinforced during a high-level seminar held in Nairobi, which brought together tax officials, private sector experts, development partners, and regional bodies to explore technology-driven solutions for tax administration.

The seminar, themed 'Driving Smarter VAT Compliance: East Africa's Digital Leap' focused on leveraging digital tools and innovative approaches to strengthen VAT systems that are critical to domestic revenue mobilisation across the region.

VAT contributes approximately 30 percent of total tax revenues in many East African countries, but its efficiency often remains below 50 percent due to persistent challenges including fraud, underreporting, and weak enforcement.